Donald Trump at the Bitcoin Conference 2024

A Vision for National Debt and Cryptocurrency

Introduction

In a landmark event, former U.S. President and Republican presidential nominee Donald Trump delivered a keynote address at the Bitcoin 2024 conference in Nashville. His speech touched on various aspects of cryptocurrency, including a bold proposal to use Bitcoin to pay down the national debt. This comes amidst significant movements in the global crypto landscape, including Germany's recent sale of a substantial portion of its Bitcoin holdings.

Trump's Vision for Bitcoin and National Debt

During his address, Trump outlined a vision where Bitcoin could play a pivotal role in managing the national debt. He criticized the current administration's approach to cryptocurrency, emphasizing a more supportive and strategic stance if he were to return to office.

"For too long our government has violated the cardinal rule that every bitcoiner knows by heart: Never sell your bitcoin," Trump stated, drawing applause from the audience. "If I am elected, it will be the policy of my administration to keep 100% of all the bitcoin the U.S. government currently holds or acquires into the future."

Trump's proposal includes the creation of a "strategic national Bitcoin stockpile," which he described as a permanent national asset. This idea aims to leverage Bitcoin's potential as a store of value and hedge against inflation, positioning the U.S. as a leader in the global crypto economy.

Germany's Bitcoin Sell-Off

Just a month before Trump's speech, Germany made headlines by selling a significant portion of its Bitcoin holdings. In January 2024, German authorities seized nearly 50,000 bitcoins, valued at around $2.2 billion at the time, from criminal activities. Over the following months, the German government sold hundreds of millions of dollars worth of Bitcoin, contributing to a sharp decline in the cryptocurrency's value[3].

This sell-off has sparked debate among investors and policymakers. Some argue that holding Bitcoin could serve as a strategic reserve currency, while others see the sale as a prudent move to mitigate risks associated with the volatile crypto market.

Trump's Response to Germany's Actions

In his speech, Trump referenced Germany's actions as a cautionary tale. He criticized the current U.S. administration for selling off Bitcoin holdings, suggesting that such moves undermine the potential benefits of holding Bitcoin as a strategic asset.

"We see other countries like Germany selling off their Bitcoin, and it's affecting the market. But we won't make that mistake. Under my administration, we will hold and accumulate Bitcoin, not sell it," Trump asserted.

The Strategic National Bitcoin Reserve

Trump's proposal for a strategic national Bitcoin reserve has garnered mixed reactions. While some view it as a symbolic gesture, others see it as a forward-thinking strategy to integrate cryptocurrency into national financial policy.

"Trump's proposal is extremely modest," said George Selgin, director emeritus of the Center for Monetary and Financial Alternatives at the Cato Institute. "It doesn't have much of an economic implication"[4].

Despite these critiques, Trump's plan has found support among crypto enthusiasts and some lawmakers. Senator Cynthia Lummis of Wyoming announced her intention to introduce legislation supporting a strategic Bitcoin reserve. According to Lummis, the reserve would help fortify the dollar against rising inflation and could be used to reduce national debt over time[5].

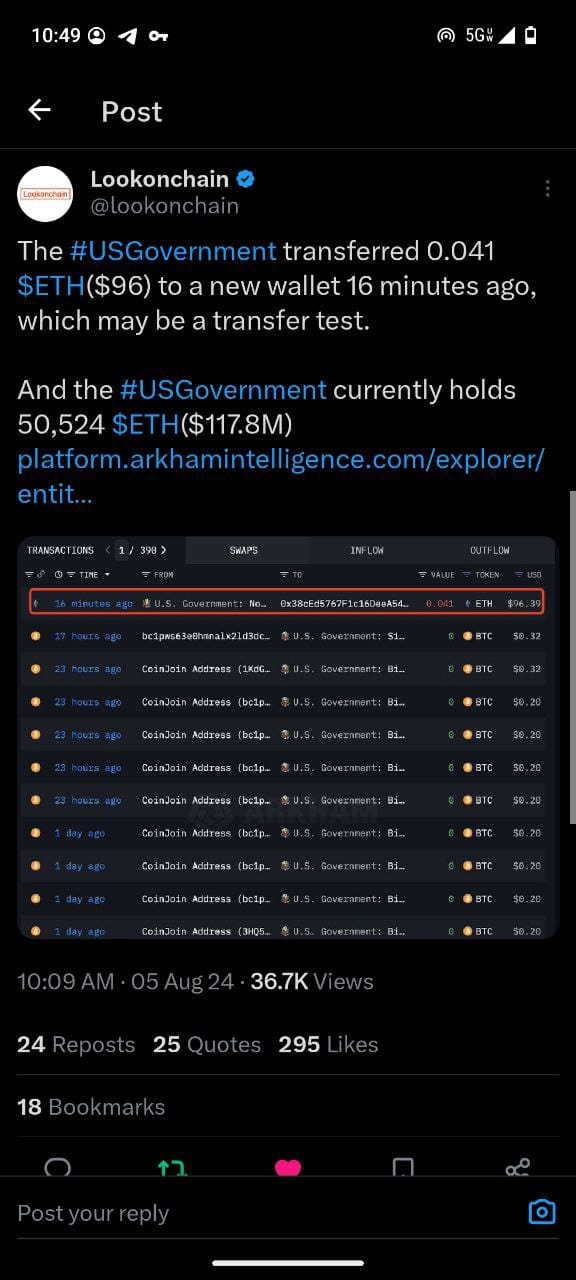

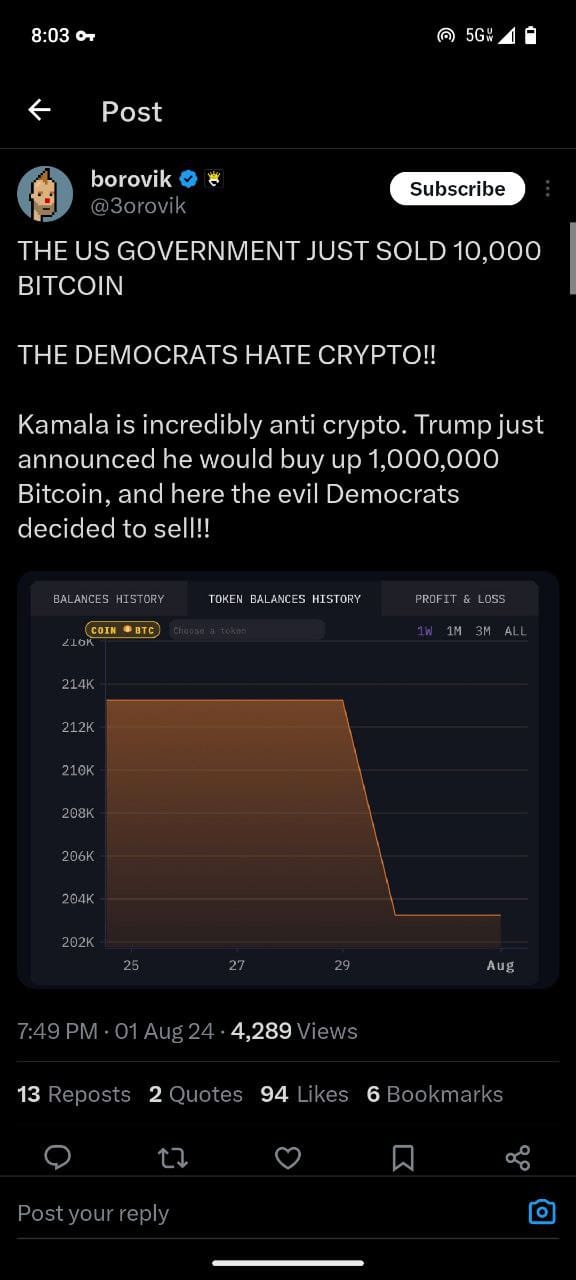

Current Administration's Stance

Contrary to Trump's vision, the current U.S. administration has been selling off Bitcoin holdings acquired through seizures from financial criminals. These sell-offs are part of the broader strategy to liquidate seized assets and redistribute the proceeds. However, this approach has faced criticism from the crypto community, who argue that holding Bitcoin could provide long-term financial benefits[6].

Conclusion

Donald Trump's speech at the Bitcoin 2024 conference has reignited the debate over the role of cryptocurrency in national financial policy. His proposal to use Bitcoin to pay down the national debt and create a strategic reserve marks a significant departure from the current administration's approach. As the crypto landscape continues to evolve, these discussions will likely shape the future of digital currency integration into national and global economies.

Trump's vision, combined with the recent actions of other nations like Germany, highlights the growing importance of cryptocurrency in financial strategy and policy. Whether or not his proposals come to fruition, they underscore the need for thoughtful consideration of how digital assets can be leveraged to address economic challenges and opportunities in the 21st century.

Citations:

[1] https://www.youtube.com/watch?v=uRQZAOK24IQ

[2] https://www.youtube.com/watch?v=EiEIfBatnH8

[3] https://www.cnbc.com/2024/07/08/germany-owns-2-billion-in-bitcoin-btc-its-freaking-out-investors.html

[4] https://www.bloomberg.com/news/articles/2024-07-31/trump-takes-not-so-surprisingly-modest-approach-with-bitcoin-btc-reserve-plan

[5] https://www.cnbc.com/2024/07/28/trump-rfk-bitcoin-america-crypto-reserve.html

[6] https://cointelegraph.com/news/trump-cautions-current-administration-not-sell-bitcoin

[7] https://tennesseelookout.com/2024/07/28/donald-trump-headlines-bitcoin-conference-in-nashville/

[8] https://www.nbcnews.com/politics/donald-trump/trump-hails-crypto-largest-bitcoin-conference-rcna163925