Binance Under Scrutiny: Alleged Seizure of Palestinian Assets at Israel’s Request

Introduction

Binance, the world’s largest cryptocurrency exchange, is embroiled in a significant controversy following allegations that it has seized the assets of Palestinian users under directives from Israeli authorities. This move has sparked outrage within the crypto community, raising questions about the autonomy of cryptocurrency exchanges, user privacy, and the broader implications of compliance with international laws.

The Allegations

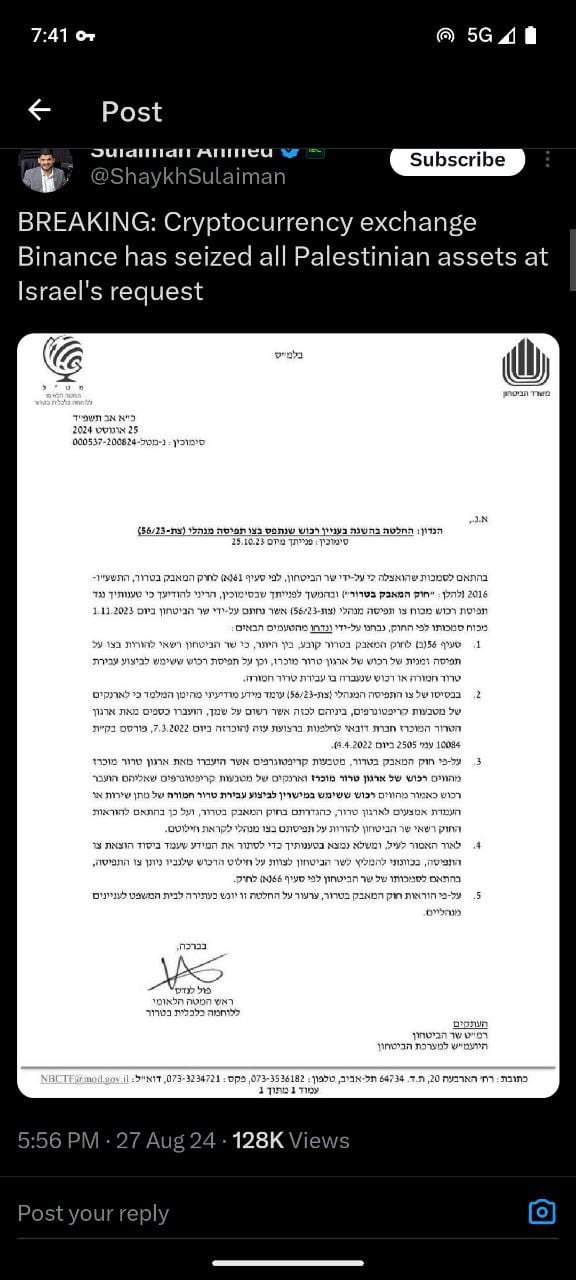

Ray Youssef, the CEO of Noones and co-founder of Paxful, claims that Binance has frozen the funds of all Palestinian users following an order from the Israel Defense Forces (IDF). According to a document purportedly from Israeli authorities, the seizures are justified under the Law on Combating Terrorism, which empowers the Israeli Minister of Defense to temporarily seize the assets of declared terrorist organizations, including cryptocurrencies.

The document, which Youssef shared on social media, suggests that hundreds of accounts have been affected, sparking concerns about the sweeping nature of these actions. Critics argue that such measures could potentially affect all Palestinians and speculate that neighboring countries like Lebanon and Syria could be next in line (International Business Times,Cryptonews).

Binance’s Response

Binance has responded to these allegations, dismissing them as “FUD” (fear, uncertainty, and doubt). The company clarified that only a small number of accounts linked to illicit activities were affected, not a blanket seizure of all Palestinian assets. A Binance spokesperson emphasized that the exchange complies with internationally accepted sanctions and anti-money laundering laws, similar to other financial institutions worldwide.

Richard Teng, CEO of Binance, reiterated that the exchange’s actions were part of standard compliance practices, and not targeted against specific user groups. Binance’s response aims to mitigate the backlash and reassure its users that it remains committed to operating within the bounds of international regulations (Crypto Briefing).

Community Reactions and Backlash

The allegations have intensified discussions within the crypto community about the vulnerabilities of centralized exchanges. Critics argue that these platforms, despite their global reach, can still fall under the influence of national governments, thereby compromising their promise of decentralization and user sovereignty. Calls to boycott Binance have gained traction on social media, with users expressing their disapproval of the exchange’s compliance with Israeli directives.

The incident also highlights the broader challenges facing cryptocurrency exchanges in balancing compliance with national laws against the foundational principles of cryptocurrency—privacy, decentralization, and user control. For Binance, the scrutiny over these actions underscores the delicate position it occupies at the intersection of regulatory compliance and user trust (International Business Times,Cryptonews).

Broader Implications

This controversy reflects the complex regulatory landscape that cryptocurrency exchanges must navigate. Governments around the world are increasingly scrutinizing digital assets as potential tools for financing activities they deem threats to national security. For exchanges like Binance, this means implementing robust anti-money laundering and counter-terrorism financing measures, even if such actions can lead to significant user backlash.

Israel’s move to seize these assets is part of a broader initiative to disrupt financial networks allegedly supporting terrorism. The Israeli government is pushing for the permanent confiscation of the funds held in these frozen accounts, citing the severity of the accusations. This situation not only puts Binance in a difficult position but also sets a precedent for how other exchanges might handle similar government pressures in the future (Crypto Briefing,Benzinga).

Conclusion

The ongoing controversy surrounding Binance’s alleged seizure of Palestinian crypto assets at Israel’s behest is a stark reminder of the challenges faced by centralized exchanges in the current geopolitical climate. As governments continue to tighten regulations on digital assets, the crypto community is left grappling with the implications of these actions on privacy, autonomy, and the future of decentralized finance. Binance’s response to this issue will likely have long-term repercussions on its reputation and the broader crypto ecosystem.