Ancient Bitcoin Wallets Awaken: The Billion-Dollar Movements Shaking Crypto Markets

In the cryptosphere, few events capture attention quite like the awakening of ancient Bitcoin wallets. Recently, the blockchain community has witnessed some of the most significant "Satoshi Era" wallet movements in Bitcoin's history, with dormant addresses from 2011 suddenly springing to life and moving billions of dollars worth of cryptocurrency. These developments offer a fascinating glimpse into Bitcoin's early days while raising intriguing questions about market dynamics and the mysterious origins of the world's first cryptocurrency.

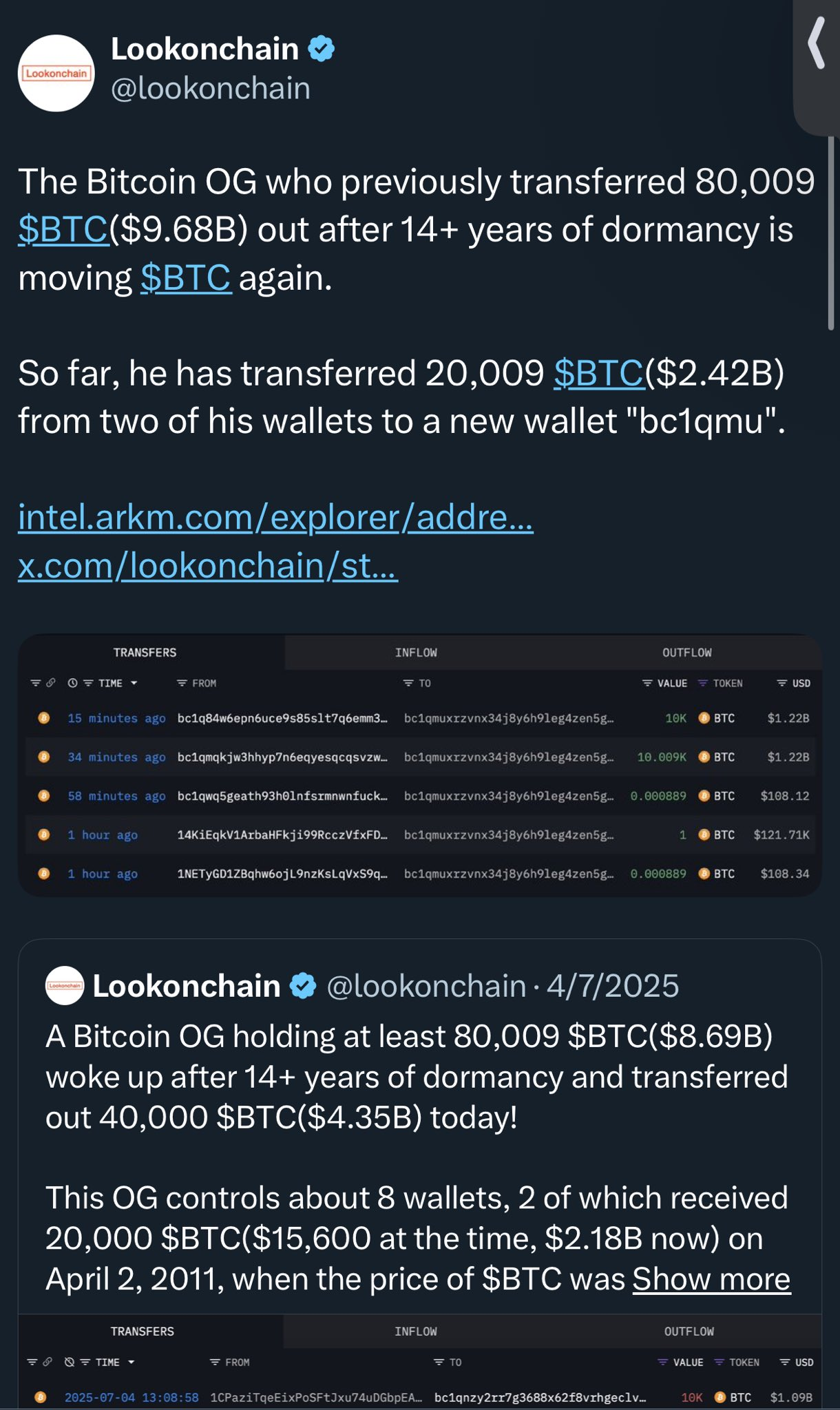

🐋 NEW: A Bitcoin whale holding 80,009 $BTC ($8.69B) has awakened after 14 years, moving 40,000 $BTC ($4.35B) today.

— Cointelegraph (@Cointelegraph) July 4, 2025

The wallets date back to 2011, when the coins were acquired for under $3.50 per $BTC. pic.twitter.com/41aJTPexXh

The Great Awakening: Record-Breaking Wallet Movements

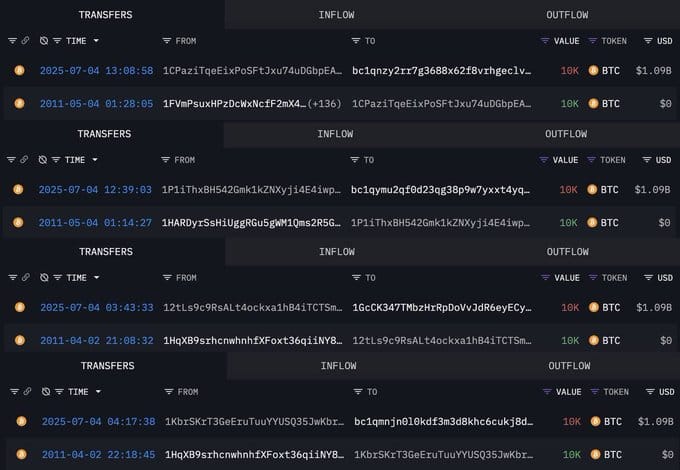

The cryptocurrency world was stunned in early July 2025 when two Bitcoin wallets that had remained untouched since April 3, 2011, simultaneously moved a staggering 20,000 BTC—worth approximately $2.18 billion at current prices. What made this event particularly remarkable was the precision of the timing: each wallet transferred exactly 10,000 BTC within minutes of each other, suggesting coordinated activity after more than 14 years of dormancy.

This massive movement was part of an even larger phenomenon that blockchain observers have dubbed the largest "Satoshi Era" transfers ever recorded. In total, eight ancient wallets moved an unprecedented 80,000 BTC, representing billions of dollars in value and highlighting the immense wealth accumulated by Bitcoin's earliest adopters.

A Pattern of Ancient Awakenings

The July 2025 movements weren't isolated incidents but rather part of a broader trend of early Bitcoin addresses becoming active again. Several other notable transactions have captured the attention of crypto enthusiasts and market analysts:

The 14-Year Dormancy: Six ancient Bitcoin addresses collectively holding 250 BTC (valued at nearly $22 million) moved their assets after an incredible 14 years of inactivity. These wallets date back to Bitcoin's infancy, when the cryptocurrency was barely known outside of cryptographic circles.

The $13 Bitcoin Era: Perhaps most striking was a wallet created on August 2, 2011, when Bitcoin was trading at just $13 per coin. This address moved 100 BTC worth $8.5 million at current prices, representing a gain of nearly 500,000% from its original value.

The $10 Million Mystery: Another 2011 wallet moved over $10 million worth of BTC after lying dormant for more than 13 years, adding to the growing list of early adopters finally accessing their long-forgotten fortunes.

These movements paint a picture of early Bitcoin pioneers who either lost access to their wallets for years or made the conscious decision to hodl through every market cycle, bull run, and crash that Bitcoin has experienced.

⚡️TODAY: A Bitcoin whale who held 80,000 $BTC since 2011 has moved 18,643 $BTC ($2B) to Galaxy Digital. pic.twitter.com/k4oeqYjdpE

— Cointelegraph (@Cointelegraph) July 15, 2025

The Satoshi Nakamoto Enigma

While these wallets are categorized as "Satoshi Era" transactions—referring to Bitcoin's earliest days when its pseudonymous creator was still active—they're not believed to belong to Satoshi Nakamoto himself. Researchers estimate that Satoshi controls between 600,000 BTC and 1.1 million BTC, an astronomical sum worth between $37 billion and $68 billion at current prices. Crucially, none of Satoshi's confirmed wallets have shown any activity, maintaining the mystery surrounding Bitcoin's creator.

However, the Satoshi connection has produced some intriguing developments. In January 2024, an unknown user sent 26.9 BTC (approximately $1.2 million) to the address Satoshi used to receive the first-ever Bitcoin block reward. This transaction sparked widespread speculation about whether it was a tribute, a test, or something more significant.

Adding to the intrigue, in July 2025, a dormant Bitcoin wallet believed by some to be associated with Satoshi Nakamoto became active with a $20,000 Bitcoin transaction after 12 years of dormancy. While this connection remains speculative and unconfirmed, it demonstrates the intense scrutiny that surrounds any wallet activity from Bitcoin's earliest days.

Market Dynamics and Price Impact

The awakening of these ancient wallets has created ripple effects throughout the cryptocurrency market, though the impact appears to be more psychological than fundamental. Bitcoin currently trades around $62,000 per coin, representing mind-boggling gains for early holders. To put this in perspective, Bitcoin was trading at roughly $600 at the time of Mt. Gox's bankruptcy in 2014, meaning the price has increased by almost 9,000% in just over a decade.

The market's reaction to these wallet movements has been mixed. While some investors worry about potential selling pressure from early adopters sitting on massive gains, others see these movements as a sign of Bitcoin's maturation and the realization of its store-of-value proposition.

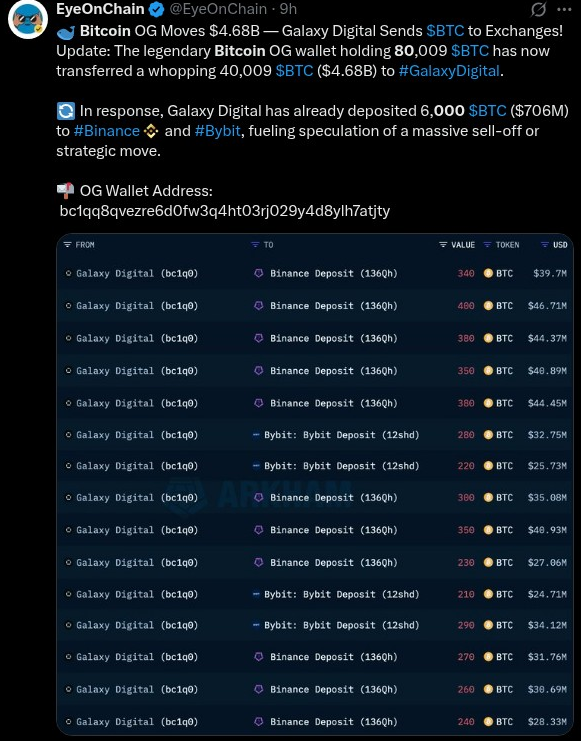

🟠UPDATE: A legendary Bitcoin OG holding 80,009 BTC ($9.46B) appears to be SELLING.

— Tommy ₿oy⚡️21m (@CooliganFields) July 15, 2025

🚨 16,843 BTC ($2B) moved to Galaxy Digital

➡️ 2,000 BTC ($236M) deposited directly to Bybit & Binance

Major liquidity event incoming? pic.twitter.com/GDdrA41t7w

Mt. Gox: The Shadow Over Bitcoin Markets

To understand the current market dynamics, it's crucial to examine the ongoing Mt. Gox situation and its comparison to these ancient wallet movements. Mt. Gox, once the world's largest Bitcoin exchange, collapsed in 2014 following a massive hack that resulted in the loss of 850,000 BTC. The exchange's bankruptcy proceedings have created a long-lasting overhang on Bitcoin markets.

Mt. Gox began repaying Bitcoin to creditors in 2024, moving billions of dollars worth of Bitcoin from its crypto wallets. Despite having distributed nearly $6 billion worth of assets to creditors earlier this year, Mt. Gox-linked crypto wallets still hold $2.7 billion worth of Bitcoin. This ongoing distribution process has created persistent concerns about selling pressure in the market.

However, a CoinShares study suggests that Mt. Gox Bitcoin sell-off fears may be exaggerated, with the actual market impact expected to be less severe than many anticipated. The study points to several factors that could mitigate the selling pressure, including the likelihood that many creditors are long-term Bitcoin believers who may not immediately sell their recovered assets.

Different Motivations, Different Impacts

The key distinction between ancient wallet movements and Mt. Gox distributions lies in the motivations of the parties involved. Early Bitcoin holders who are moving coins after 14+ years of dormancy are sitting on astronomical gains and likely have very different incentives compared to Mt. Gox creditors or government auction participants.

These early adopters have already demonstrated extraordinary patience and conviction by holding through multiple market cycles. Their decision to move coins now might be driven by estate planning, diversification, or simply the desire to enjoy the fruits of their early belief in Bitcoin. As a result, they're more likely to be strategic about their selling approach, potentially spreading transactions over time to minimize market impact.

In contrast, Mt. Gox creditors and government auctions tend to create more immediate and concentrated selling pressure. Creditors who have waited years to recover their assets may be more inclined to sell quickly, while government auctions typically involve predetermined sale schedules that can create predictable selling pressure.

The Broader Implications

These wallet movements represent far more than just large financial transactions—they're a testament to Bitcoin's remarkable journey from an experimental digital currency to a globally recognized store of value. The fact that wallets from 2011 are now worth billions of dollars validates the early vision of Bitcoin as a revolutionary monetary system.

For the cryptocurrency market, these movements highlight several important trends. First, they demonstrate the incredible wealth creation potential of being an early adopter in transformative technologies. Second, they show how Bitcoin's fixed supply cap of 21 million coins has created scarcity value that benefits long-term holders. Finally, they underscore the importance of secure key management—many early Bitcoin holders likely lost access to their wallets permanently, effectively removing those coins from circulation forever.

Looking Forward

As Bitcoin continues to mature as an asset class, we can expect to see more ancient wallets awakening as early adopters decide to access their long-dormant wealth. Each movement tells a story of conviction, patience, and the transformative power of revolutionary technology.

The ongoing saga of these ancient Bitcoin wallets serves as a powerful reminder of the cryptocurrency's humble beginnings and extraordinary growth. Whether these movements represent the end of an era or simply the beginning of a new chapter in Bitcoin's story remains to be seen. What's certain is that they've provided a fascinating glimpse into the early days of what has become one of the most significant financial innovations of the 21st century.

For investors and observers, these developments offer valuable insights into Bitcoin's market dynamics, the psychology of early adopters, and the long-term implications of digital scarcity. As the cryptocurrency ecosystem continues to evolve, the awakening of these ancient wallets will likely remain one of the most compelling narratives in Bitcoin's rich and complex history.

This Bitcoin OG with 80,009 $BTC($9.46B) transferred another 7,843 $BTC($927M) to #GalaxyDigital, for a total of 16,843 $BTC ($2B).

— Lookonchain (@lookonchain) July 15, 2025

Galaxy Digital is depositing $BTC to exchanges, and 2,000 $BTC($236M) has been directly deposited to #Bybit and #Binance.https://t.co/Sm9UBYboIN pic.twitter.com/rwxHtrV0DQ